Sustainability reporting standards for SMEs

At present, SMEs are not required to provide a sustainability statement under CSRD. Capital market-oriented SMEs will be affected starting from 2026, while non-capital market-oriented SMEs are not required to report. In both cases, however, it can be assumed that large companies, as part of the value chain, as well as investors, will demand sustainability information from them. To support SMEs, the European Financial Reporting Advisory Group (EFRAG) has developed ESRS LSME and ESRS VSME specifically for SMEs, which have now been released in draft form. The SME standards consist of ESRS LSME (standard for "Listed Small- and Medium-Sized Enterprises") for capital market-oriented SMEs and ESRS VSME ("Voluntary" standard for "Small- and Medium-Sized Enterprises") for non-capital market-oriented SMEs. While the ESRS LSME standard will be mandatory for capital market-oriented SMEs and will be incorporated into a legal act, the ESRS VSME standard is a voluntary standard that will not be issued as a legal act. What both standards have in common is the consideration of the principle of double materiality.

The consultation for both standards drafts run until 21 May 2024.

ESRS for capital market-oriented SMEs (LSME)

The draft ESRS LSME sets out reporting requirements for SMEs whose securities are traded on a regulated market and are subject to CSRD from the financial year 2026, or from the financial year 2028 (with an "opt-out option"). This standard is particularly relevant as it establishes, according to Article 29b(4) of the CSRD, the upper limit of information that large companies can demand from SMEs in the area of sustainability. ESRS LSME is intended to enable reporting of relevant information with reasonable effort, taking into account the capacities and characteristics of companies in value chains as well as the scope and complexity of their activities.

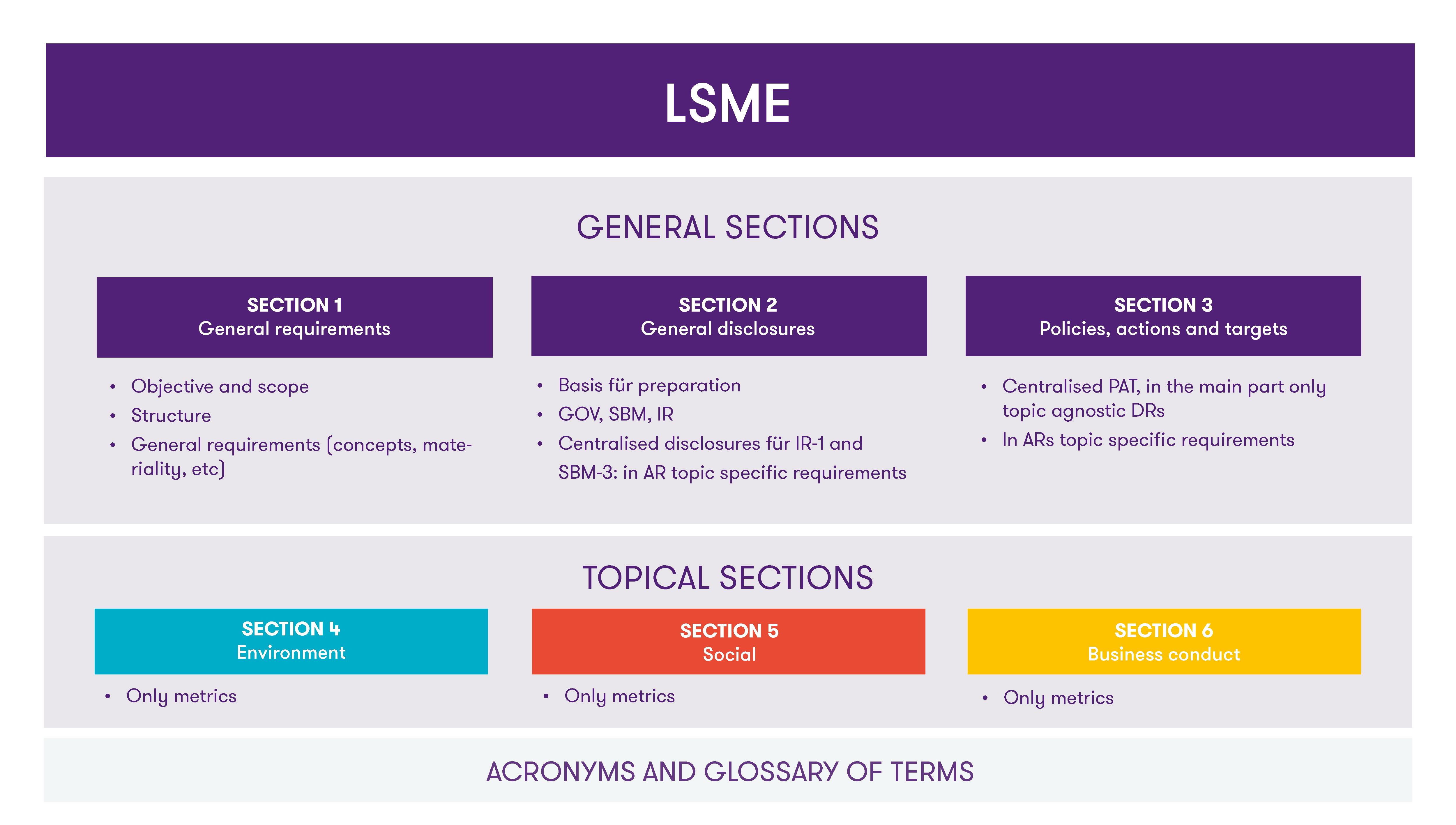

Compared to the ESRS for large public-interest entities ("ESRS Set 1”), the ESRS LSME draft provides for simplifications and aims for a balance between reasonable reporting requirements for SMEs and the information needs of investors and companies in the downstream value chain. The draft ESRS LSME comprises three overarching areas ("General Requirements", "General Disclosures" and "Policies, Actions and Targets") and three sections for metrics relating to environmental, social and governance ("ESG").

Structure of the standards for capital market-oriented SMEs

Source: EFRAG. 2024 ESRS LSME ED Basis for conclusions. Structure of the ESRS LSME ED, p.12

Voluntary ESRS for non-capital-market-oriented SMEs (VSME)

The draft of the voluntary ESRS VSME provides a simplified reporting format to assist non-capital market-oriented micro, small and medium-sized enterprises in starting sustainability practices and efficiently and proportionately responding to requests for sustainability information. The aim is to support SMEs in preparing sustainability data and to achieve standardization in requests from business partners. The draft voluntary standard consists of a mandatory basic module for all users and two additional optional modules ("Narrative Policies, Actions and Targets (PAT)" and "Business Partners"). The Business Module is intended for SMEs to uniformly and in a standardized manner respond to inquiries from their business partners.

What does this mean for companies and what needs to be done?

With the publication of the drafts of the ESRS LSME and ESRS VSME, it becomes clearer what reporting requirements the CSRD places on SMEs and enables greater standardization of sustainability information, even for small and medium-sized enterprisesEngaging with the LSME standard is of great relevance for both SMEs and large public-interest entities, as it sets the upper limit for sustainability-related enquiries to small and medium-sized enterprises. Therefore, we recommend non-capital market-oriented SMEs to familiarize themselves with both the ESRS VSME and the ESRS LSME. Although the ESRS VSME remains voluntary according to current information, and the future extent of its future application is uncertain, this standard provides a guide for structuring and facilitates the preparation of sustainability information.

After the consultation period ends in May 2024, the adoption of ESRS LSME as a delegated act is expected. It is anticipated that ESRS VSME, while not binding as a legal act, will be finalized in parallel. Until then, companies should monitor the further development of the standard-setting process, in particular the results of the public consultation.

For further information on these standards and support with CSRD-compliant sustainability reporting, Grant Thornton is available as a contact partner.