Our ‘Insights into IFRS 3’ series summarises the key areas of the Standard, highlighting aspects that are challenging to interpret and apply in practice. This article follows on from our published article ‘Insights into IFRS 3 – Identifying the acquirer’ and presents guidance for an area which is difficult in practice – reverse acquisitions.

What is a reverse acquisition?

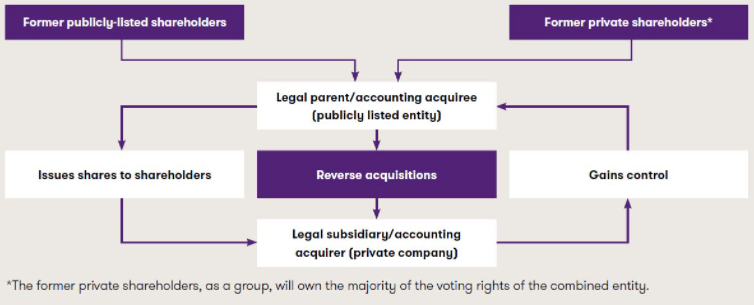

A reverse acquisition occurs when an entity that issues securities (the legal parent or the legal acquirer) is identified as the accounting acquiree, and accordingly, the legal subsidiary (or the legal acquiree) is identified as the accounting acquirer.

One situation in which reverse acquisitions often arise is when a private operating entity wants a fast-track to a public listing. To accomplish this, the private entity arranges for its equity interests to be acquired by a smaller, publicly listed entity. The listed entity carries out the acquisition by issuing shares to the shareholders of the private operating entity. After the exchange of shares, the former shareholders of the private entity, as a group, hold the majority of the voting rights of the combined entity. In addition, the former shareholders of the private entity then appoint the majority of the members of the new combined entity’s board. In this case, although the publicly listed entity issued shares to acquire the private entity, the listed entity will be identified as the accounting acquiree and the private entity as the accounting acquirer as the former shareholders of the private entity, as a group, have obtained the control over the combined entity.

This is explained in the following diagram:

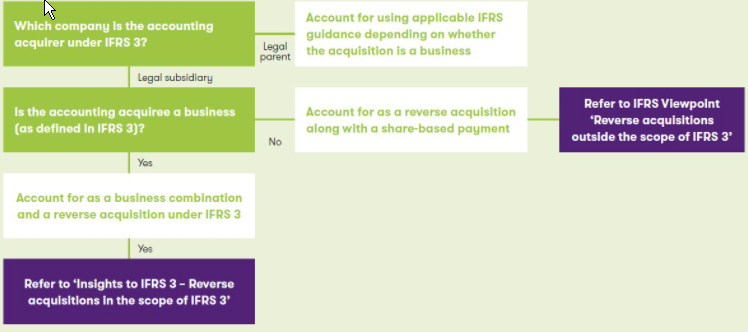

Is the reverse acquisition transaction a business combination?

Answering this question involves determining:

- which company is the ‘accounting acquirer’ under IFRS 3, ie the company that obtains effective control over the other, and

- whether or not the acquired company (ie the ‘accounting acquiree’) is a business as defined in IFRS 3.

Identifying the acquirer

When a transaction between entities is carried out primarily by exchanging shares, the entity that obtains the control over the other entity is the accounting acquirer. Although IFRS 3 indicates to use the guidance in IFRS 10 to identify such acquirer, in practice, the factors listed in IFRS 3 with regards to the transactions effected by an exchange of equity interests should also be analysed. Refer to our article ‘Insights into IFRS 3 – Identifying the acquirer’ for more details on this guidance.

The following facts and circumstances are likely to indicate the legal subsidiary is the accounting acquirer:

- the former shareholders of the legal subsidiary, as a group, retain or receive the largest portion of the voting rights in the new combined entity (which include potential voting rights that could be exercised)

- the relative size (measured in, for example, assets, revenues or profit) of the legal subsidiary is significantly greater than that of the legal parent

- the former owners or managers of the legal subsidiary dominate the composition of the governing body or senior management of the combined entity.

PRACTICAL INSIGHT

-

The IFRS Interpretations Committee (IFRIC) received a request to clarify whether a business (legally acquired) that is not a legal entity could be considered to be the accounting acquirer in a reverse acquisition under IFRS 3. In September 2011, the IFRIC observed that IFRS standards do not require a ‘reporting entity’ to be a legal entity. Therefore, an acquirer that is a ‘reporting entity’ but not a legal entity can be considered to be an accounting acquirer in a reverse acquisition. This IFRIC decision has raised some issues in practice on how to determine the boundaries of the assets and liabilities of the business and the nature of the equity that is transferred.

What if the legal acquirer transfers also cash?

When a legal parent pays cash to acquire shares in a subsidiary the transaction would normally be accounted for as a regular business combination, ie considering the entity that is transferring cash is the acquirer. However, in some circumstances the business combination can still be considered a reverse acquisition even if cash is transferred from the legal parent to the owners of the legal subsidiary where other facts demonstrate the legal subsidiary is finally the accounting acquirer.

An important determining factor in identifying the acquirer is control. When it is clear as part of this transaction the legal subsidiary has obtained control over the legal parent (in accordance with the definition of control as stated in IFRS 10 ‘Consolidated Financial Statements’), the transaction should then be accounted for as a reverse acquisition. While this is a possible scenario, and one that can be challenging to deal with in practice, we do not believe reverse acquisitions with a payment in cash are common in practice.

What is a business?

This is one of the most commonly asked application questions in practice, in part because the answer makes a significant difference to how the transaction is accounted for. IFRS 3 includes both a definition of a business and some detailed supporting guidance.

What are the minimum requirements to meet the definition of a business?

IFRS 3 acknowledges that despite most businesses having outputs, outputs are not necessary for an integrated set of assets and activities to qualify as a business. In order to meet the definition of a business, the acquired set of activities and assets must have as a minimum an input and a substantive process that can collectively significantly contribute to the creation of outputs.

DEFINITION

-

A business is defined as ‘An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities.’

Furthermore, IFRS 3 includes an optional concentration test that could be relevant in the present context. Refer to our article ‘Insights into IFRS 3 – Definition of a business’ for more details, Including how to apply the optional concentration test. In our view, a listed shell company that has no current substantive operations, and whose activities mainly involved managing its cash balances and filing obligations, would not meet the criteria of a business. This is because it has no substantive processes. For this reason, we consider many transactions in which a private operating company arranges to be acquired by a listed shell company are not business combinations and therefore fall outside the scope of IFRS 3.

How to account for a reverse acquisition

The following diagram illustrates the two possible accounting treatments, with reference to the relevant publications, when facing a reverse acquisition:

How we can help

We hope you find the information in this article helpful in giving you some insight into IFRS 3. If you would like to discuss any of the points raised, please speak to our experts Christoph Zimmel and Rita Gugl.