Our first article in the Insights into IAS 36 series provides an ‘at a glance’ overview of IAS 36’s main requirements and outlines the major steps in applying those requirements.

Objective of IAS 36

The objective of IAS 36 is to outline the procedures an entity should apply to ensure the carrying values of all its assets are not stated above their recoverable amounts (the amounts to be recovered through use or sale of the assets). To accomplish this objective, IAS 36 provides guidance on:

- the level at which to review for impairment (eg individual asset level, cash-generating units (CGU) level or groups of CGUs)

- if and when a quantitative impairment test is required, including the indicator-based approach for an individual asset that is not goodwill, an indefinite life intangible asset or intangible asset not yet ready for use

- how to perform the quantitative impairment test by estimating the asset’s (or CGU’s) recoverable amount

- how to recognise and reverse an impairment loss

- when and under what circumstances an entity must reverse an impairment loss, and

- the detailed disclosure requirements (both in the case of

impairment and also in the absence of impairment).

IAS 36: Key definitions

IAS 36 defines key terms that are essential to understanding its guidance. The most significant definitions are highlighted below:

- Carrying amount - The amount at which an asset is recognised after deducting any accumulated depreciation (amortisation) and accumulated impairment losses thereon.

- Impairment loss - The amount by which the carrying amount of asset or a CGU exceeds its recoverable amount.

- Recoverable amount - The higher of an asset or CGU’s fair value less costs of disposal (FVLCOD) and its value in use (VIU).

- Value in use - The present value of the future cash flows expected to be derived from an asset or CGU.

Below is a summary of IAS 36’s main requirements, click on each area of IAS 36 to expand.

The overall principle in IAS 36 is that assets should not be carried above their recoverable amount.

IAS 36 applies to all assets other than those for which the measurement requirements of other IFRS are such that an IAS 36-based impairment review is irrelevant or unnecessary. Assets outside IAS 36’s scope include:

- inventories

- financial assets in the scope of IFRS 9 ‘Financial Instruments’

- contract assets and assets arising from costs to obtain or fulfill a contract recognised in accordance with IFRS 15 ‘Revenue from Contracts with Customers’

- deferred tax assets

- assets arising from employee benefits

- assets classified as held for sale

- investment property measured using the fair value model

- biological assets related to agricultural activity within the scope of IAS 41 ‘Agriculture’ measured at fair value less costs to sell, and

- contracts that are assets and any assets for insurance acquisition cash flows in the scope of IFRS 17 ‘Insurance Contracts’.

IAS 36 does apply to:

- financial assets classified as subsidiaries, associates and joint ventures (unless measured at fair value)

- property, plant and equipment and intangible assets carried at a revalued amount in accordance with other IFRS, and

- Right-of-use assets measured in accordance with IFRS 16 ‘Leases’.

IAS 36 defines key terms that are essential to understanding its guidance including, but not limited to:

- CGU

- corporate assets

- costs of disposal

- impairment loss

- recoverable amount

- VIU

- FVLCOD

IAS 36 prescribes the timing requirements for performing quantitative impairment testing as well as potential ‘indicators’ of impairment that may trigger impairment testing for some assets or groups of assets. Specifically, IAS 36 requires that:

- goodwill, indefinite life intangibles and intangible assets not yet available for use are tested for impairment at least annually, in addition to when there is any indication of impairment, and

- all other assets are tested for impairment when there is any indication that the asset may be impaired.

IAS 36 also outlines some limited exceptions to the requirements noted above.

IAS 36 prescribes the level of review for impairment:

- where possible, an entity will estimate the recoverable amount of an individual asset, or

- when this is not possible, an entity will determine the recoverable amount of the CGU ton which an asset belongs.

For the purposes of impairment testing, IAS 36 prescribes how to allocate goodwill and coroporate assets to CGUs.

When an entity needs to test an asset or CGU for impairment, it must determine its recoverable amount. IAS 36 defines the recoverable amount as the higher of the asset’s or CGU’s FVLCOD and VIU.

IAS 36 provides guidance to determine FVLCOD including:

- providing examples of ‘costs of disposal’ and items that do not meet that definition, and

- outlining situations where it may be necessary to consider some recognised liabilities to determine the recoverable amount.

IAS 36 prescribes the elements that should be reflected in the calculation of an asset’s or CGU’s VIU including:

- an estimate of the future cash flows the entity expects to derive from the asset

- expectations about possible variations in the amount or timing of those future cash flows

- the time value of money

- the price for bearing the uncertainty inherent in the asset, and

- other factors such as illiquidity that market participants would reflect in pricing the future cash flows the entity expects to derive from the asset.

The guidance provides additional considerations in determining an appropriate estimate/rate for each of the above elements.

IAS 36 requires an entity to recognise an impairment loss when the carrying amount of an asset or CGU exceeds its recoverable amount, and provides guidance on how to recognise that loss,

by outlining:

- the requirements for recognising and measuring impairment losses for an individual asset

- the requirements for allocating losses when such losses are calculated for a CGU, and

- additional considerations for allocating an impairment loss when there is a non-controlling interest.

IAS 36 sets out the requirements for reversing an impairment loss recognised for an asset or CGU in prior periods by:

- prescribing timing for assessment

- providing indicators that an impairment loss recognised in prior periods for an asset (other than goodwill) or CGU may no longer exist or may have decreased, and

- prescribing the accounting for reversing a prior impairment loss, including limitations on the amount that can be reversed.

IAS 36 sets out the disclosure requirements related to impairment. Some disclosures apply in the event an entity records an impairment loss while others are required irrespective of any impairment loss.

IAS 36’s step by step impairment approach

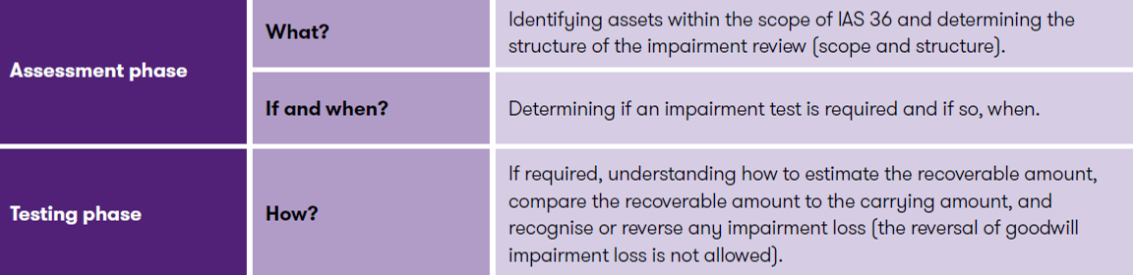

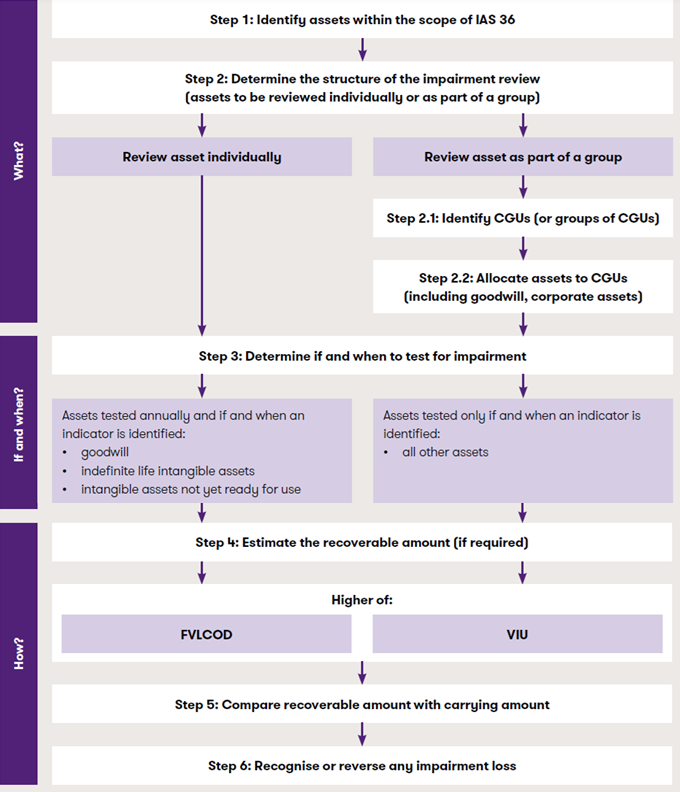

IAS 36 prescribes the procedures that an entity applies to ensure that assets are carried at no more than their recoverable amounts (the impairment review). Very broadly, the impairment review comprises:

- an assessment phase, and

- a testing phase, if required.

We use the phrase ‘impairment review’ to encompass both the assessment and testing phase. In the assessment phase management:

- identifies the assets within the scope of IAS 36

- identifies the assets for which a quantified impairment test is required. Goodwill, indefinite life intangibles and those not available for use are tested at least annually, even if there is no indication they might be impaired. Other assets are assessed and are tested only if one or more indicators are identified

- determines which assets will be tested individually and which as part of a CGU or group of CGUs, and identifies the CGUs to which assets belong (we refer to this as the ‘structure’ of the impairment review). IAS 36 requires that an entity tests individual assets wherever possible; however, it is usually not possible to determine the recoverable amount for an individual asset. As a result, more times than not, management must identify the CGU (or groups of CGUs) to which the individual asset relates. Additionally, management must allocate goodwill and corporate assets to a CGU (or groups of CGUs) for the purpose of applying IAS 36.

These steps determine the scope of the quantified impairment testing (the testing phase). In the testing phase management:

- estimates the recoverable amount for the assets and CGUs as required

- compares the recoverable amount to the carrying amount, and

- records (or reverses, if applicable) any impairment loss, to the individual assets, or allocated among the assets in impaired

CGUs in accordance with IAS 36’s guidance.

With this in mind, the following step-by-step guide is useful in applying IAS 36:

How we can help

We hope you find the information in this article helpful in giving you some insight into IAS 36. If you would like to discuss any of the points raised, please speak to our experts Christoph Zimmel and Rita Gugl.