This article is the second of a three-part series on cashgenerating units (CGUs). In this article we discuss how to allocate assets to CGUs, which follows an article on how to identify CGUs and then finally we will discuss how to allocate goodwill to CGUs.

Identifying CGUs is a critical step in the impairment review and can have a significant impact on its results. That said, the identification of CGUs requires judgement.

The identified CGUs may also change due to changes in an entity’s operations and the way it conducts them.

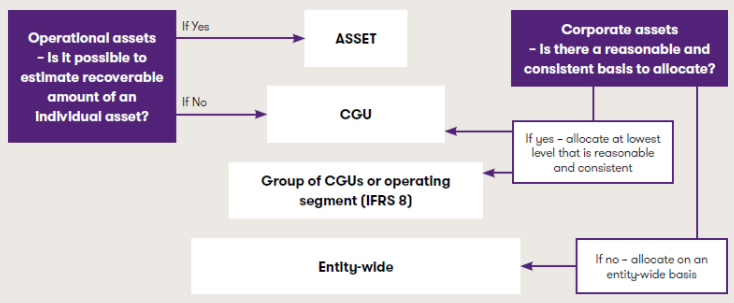

After the entity identifies its CGUs it must determine which assets belong to which CGUs, or groups of CGUs. The basis of allocation differs for:

- operational assets

- corporate assets, and

- goodwill.

The below diagram summarises the different allocation bases for assets:

Operational assets

As discussed in our previous article, recoverable amount is determined (if required) at the level of individual assets when possible. Where it is not possible to estimate the recoverable amount of the individual operational asset it is allocated to the CGU to which it belongs.

Assets that contribute to the cash flows of a CGU also need to be allocated to that CGU even if it is possible to determine recoverable amount individually (because, for example, an asset’s value in use (VIU) can be estimated as similar to its fair value less costs of disposal (FVLCOD)). This is to ensure a like-for-like comparison when the CGU is tested and its recoverable amount is compared to its carrying value.

The discussion in ‘Insights into IAS 36 – Identifying cash-generating units’ provides guidance on identifying the CGU to which an asset belongs.

Corporate assets

In some cases, management may identify certain assets that contribute to the estimated future cash flows of more than one CGU. It would be inappropriate to allocate these assets entirely to a single CGU. Such assets are referred to as ‘corporate assets’ or ‘shared assets’ and may include (for example):

- a headquarters building

- IT equipment

- research centre, or

- corporate or global brands.

Distinctive characteristics of corporate assets are that they do not generate cash inflows independently of other assets or groups of assets and their carrying amount cannot be fully attributed to the CGU under review.

If there is an indication of impairment for the corporate asset itself, recoverable amount cannot be determined at the individual asset level, unless management has decided to dispose of it (because corporate assets do not generate separate cash inflows).

Corporate assets therefore need to be incorporated into the impairment review at the CGU level – not only to test the asset in question (when necessary), but also to test the CGUs that benefit from those assets. To do so, the entity should:

- identify corporate assets that relate to the CGU under review, and

- allocate the carrying amount of the corporate assets on a reasonable and consistent basis to the CGU under review (if a reasonable and consistent basis can be identified).

Where a portion of the carrying amount of a corporate asset cannot be allocated on a reasonable and consistent basis, the assets are incorporated into the impairment review at a higher level and the analysis becomes more complicated. This will be addressed in a later article.

Example 1 -Identification and allocation of corporate assets to CGUs

Entity E has four CGUs: A, B, C and D. The carrying amounts of those units do not include goodwill. During the period, significant adverse changes in the legal environment in which Entity E operates take place. Entity E conducts impairment tests of each of its CGUs in accordance with IAS 36. At the end of the period, the carrying amounts of CGUs A, B, C and D are CU100, CU200, CU300 and CU250, respectively.

The four CGUs all utilise a central office and a shared global brand (carrying amounts of CU100 and CU75, respectively). Management of E has determined the relative carrying amounts of the CGUs are a reasonable approximation of the proportion of the central office building devoted to each CGU, but the carrying amount of the global brand cannot be allocated on a reasonable and consistent basis to the individual CGUs.

The remaining estimated useful life of CGUs A, B, C and D are 10, 15, 15 and 20 years respectively. The central office has a remaining useful life of 20 years and is depreciated on a straight-line basis.

Analysis

Ignoring tax effects, Entity E identifies all corporate assets that relate to the individual CGUs under review (the central office and shared global brand).

Entity E concludes the carrying amount of the central office can be allocated on a reasonable and consistent basis to the CGUs under review while the carrying amount of the global brand cannot.

Although not the only way to do so, Entity E allocates the carrying amount of the central office to the carrying amount of each individual CGU using a weighted allocation basis because the estimated remaining useful life of A’s CGU is 10 years, whereas the estimated remaining useful lives of B and C’s CGUs are 15 years and D’s CGU is 20 years.

Practical insightAllocating corporate assetsIAS 36 provides only limited guidance as to what is meant by ‘allocated on a reasonable and consistent basis’ for allocation of corporate assets to CGUs or groups of CGUs. Judgement is therefore required. This judgement will depend on the nature of the asset and should aim to reflect the extent to which each CGU benefits from the corporate asset. In our view, however, a reasonable and consistent basis of allocation should normally be possible in most circumstances by taking a pragmatic approach, even if the benefits obtained by the CGU are less clear-cut or observable. the example above shows one such pragmatic approach (allocating corporate assets using CGUs’ carrying amounts, weighted by their useful lives) but several other methods could also be supportable (for example, headcount, revenue, floor space or utilisation metrics depending on the circumstances). |

Practical insightCorporate assets and shared corporate costs in the regulatory spotlightIn estimating VIU for a CGU that benefits from a corporate asset, an entity must ensure it also allocates shared corporate costs relating to that corporate asset. A regulatory decision published in the April 2013 European Securities and Markets Authority (ESMA) Report (ESMA/2013/444) highlights this point whereby an issuer did not allocate the costs of corporate officers to the individual CGUs on the basis the cash flows benefited the company as a whole rather than the individual CGUs (highlighting the criterion of independency of cash flows when determining the cash inflows and outflows of a CGU). In the regulator’s view, the corporate costs were cash outflows that were necessarily incurred to generate the cash inflows from continuing use of the assets and could be allocated on a reasonable and consistent basis to the asset. The regulator concluded excluding certain corporate costs from the costs allocated to CGUs did not comply with the requirements of IAS 36 and all cash outflows had to be included in the cash flow forecasts. The corporate costs were cash outflows that, according to IAS 36, were necessarily incurred to generate the cash inflows from continuing use of the CGU’s assets and could be allocated on a reasonable and consistent basis to the CGU. |

How we can help

We hope you find the information in this article helpful in giving you some insight into IAS 36. If you would like to discuss any of the points raised, please speak to our experts Christoph Zimmel and Rita Gugl.