Putting the brakes on the recovery were the threats Grant Thornton warned about at the half year stage, specifically the supply crunch and inflationary risks. In the second half of 2021, inflation moved from an impending risk to an immediate danger, with higher labour and energy costs being added to the long list of business challenges including access to finance, availability of skills and regulations and red tape.

Peter Bodin, CEO of Grant Thornton International Ltd, is still quick to celebrate the progress achieved. “Although rising energy costs, talent shortages and ongoing Covid uncertainty are creating real challenges, the fact that the mid-market remains optimistic is testament to the strong leadership, dynamism, and resilience within this critical part of the global economy.”

The index recorded gains in 19 of the 29 countries we surveyed and most of the major regions monitored. Progress was particularly strong in developed APAC and ASEAN, with gains of 4 and 6.1 points respectively. While progress in North America and the EU was more sedate, with both improving by 2.2 points.

The Global business pulse results provide a unique and vital read of the health of mid-market companies, with the index score being a measure of positive or negative business health. It is based on the largest and longest running survey of the mid-market, the International Business Report, with the most recent interviews of around 5,000 mid-market leaders taking place between October and November 2021. The sections below provide the full health report for the mid-market globally.

Headlines from the latest Global business pulse

Inflation becomes a clear and present danger

After flagging the approaching threat of inflation in our last review, we see from a range of troubling indicators that it has now arrived. On the input side, some 59% of mid-market companies globally are now concerned about labour costs, meaning it’s jostling with economic uncertainty for top mid-market constraint. And concerns about energy costs are also up sharply, with 56% of companies highlighting this as a key concern. This mirrors economic trends being seen around the world. In the US, consumer inflation rose to 6.8% in November 2021, the highest level in nearly 40 years. Though less of a concern in Asia, in the EU the rate was 4.9%. Brazil recorded a rate of 10.7% and Russia 8.4%.

“Inflation is now a major challenge for businesses and what was once a boat on the horizon is now a ship in port,” says Mike Ward, global head of advisory at Grant Thornton International Ltd. “This is an environment which most business people have not seen in their careers. In most major Western economies there hasn’t been an inflationary environment for close to 50 years so there are very few people who remember the lessons from the past.”

Higher costs can squeeze profitability unless selling prices offset them, but also bring the prospects of higher interest rates to control inflation, which can dramatically slow demand and push up costs of borrowing. Encouragingly, a little over half of companies (51%) expect to increase their selling prices in the next 12 months. This is the highest level on record, and helps explain why mid-market leaders expect no material change in profits yet. Some 57% of companies expect to increase their profits in the next 12 months, 1 percentage point up on the H1 results.

Hopefully this confidence is justified and it is certainly a good time to increase prices given the strong demand. However, our leaders stress the need for companies to draw up plans to manage inflation now, given the risks and growing uncertainty over its duration. In December 2021, the Financial Times commented that talk of inflationary pressure being temporary or ‘transitory’ was gone and that central banks in the EU, US and UK are now concerned that inflation is becoming persistent.

Some suggested starter actions are to manage costs carefully and creatively – buy more in advance to lock in prices, hedge where possible, even look at reverse auctions – but also try to become more efficient and do more with less. Technology is the key to efficiency, and we’ll be exploring digital and IT opportunities more in upcoming content.

For those companies facing supply constraints, Mike suggests they use this period to look at the profitability of their products and customers, and really consider where to focus. “Generally, you wouldn’t want to get rid of customers when you have excess capacity, but when you are capacity constrained and have to make tough choices anyway, now is a good time to look at your customer base, and weed out those that may not have been too loyal or have a disproportionately high cost to serve.” Activity-based costing or management cost accounting will help you understand the true costs and profitability of serving customers – talk to our expert Andrew Dickson if you need support with this .

Another strategic move that will help at the present time is to increase pricing power by focussing on product or service differentiation. While this is not an overnight exercise, Robert Hannah, leader of the international business support function at Grant Thornton International Ltd, describes it as being “absolutely vital”. “You need to focus on your unique point of differentiation that adds value to the customer and allows you to stand out from the crowd to ensure you achieve the price point you are after.”

The war for talent gets even fiercer

‘War’ is the only fitting description for the intensity of contest for labour skills and it’s getting even fiercer. The underlying problem is the shortage of available skills. That’s clearly seen in the fact that a record 57% of all mid-market companies now see this as a constraint to their growth, nearly twice the long-term average.

The shortage of skills is an issue across every country and region monitored by our research, and in North America it’s reached the level where more than two-thirds of businesses say it’s a constraint to their growth. This chimes with research done by Grant Thornton US which found that two-thirds of US HR leaders believe there is now a ‘war for talent’, and also shows that 33% of employees are actively looking for a new job.

Tim Glowa, Principal - Human Capital Services at Grant Thornton US says, “The talent shortage is either the number one or number two issue facing US organisations. And it’s not just an HR problem, it’s a C-suite problem. Because if you have talent shortages, you are not going to achieve your growth objectives.”

In addition to driving higher labour costs, the skills shortage is also behind the sky-high numbers of companies planning to pay higher salaries in the next 12 months. 71% of the mid-market are expecting to pay salary increases that are at least in line with inflation in the next 12 months. What is even more concerning here is that competition for skills may only intensify, given that 52% of companies plan to increase their employment in the coming year to support their growth plans.

There’s no single way to win this talent war, but Tim stresses the importance of understanding the needs of employees and developing rewards packages that they value and that really differentiate you as an employer. “Our State of Work research found that 55% of employees think their total reward programme is no different to what’s available elsewhere. They can get the same benefits by crossing the road and joining a competitor.” Robert suggests companies may even want to think about options like profit sharing and share ownership to help buy loyalty and really differentiate offerings to employees.

In this skill-sellers’ market, our experts stress the importance of also looking well beyond financial rewards to keep good talent and make companies attractive in the market. In light of COVID, a new model of leadership is needed to enable organisations to thrive. Engendering innovation, collaborating and communicating across the business, and adapting to change have become operational necessities for C-suite leaders, while empathy and inclusion are the keys to team performance. Grant Thornton has provided a wealth of good ideas for creating an working culture that is diverse, inclusive and psychologically safe enough to attract and retain talent in this competitive landscape.

It’s also important to fish from the global pool and embrace the opportunities of remote working, but beware. Richard Tonge, Principal - Global Mobility Services in the US, says there are still a raft of tax risk considerations and practical monitoring challenges associated with a more international workforce. He notes that companies are looking at different models of engaging talent to meet need in the competitive environment, be this as contractors or through professional employment organisation or separate legal entities.

International opportunities Zoom ahead for mid-market

The final headline is that the stampede of mid-market companies looking to expand internationally continues, despite the added challenges of transport costs and disruptions. The percentage of companies expecting to increase exports in the next 12 months remains high at 45%, while the percentage expecting to increase international revenue has risen 3 percentage points to 44%.

Peter notes, “The shift by many companies towards engaging with international customers shows how the digital commercial environment is opening up opportunities to expand internationally and enabled faster speed to market.” Earlier this year we found that most international companies now primarily sell to and service their customers virtually. For many, this shift to virtual has opened up greater opportunities to expand internationally and enabled faster speed to market, which many industries, like professional services and healthcare, have been quick to exploit.

The downside is that there are growing concerns about customer loyalty and more of a focus on price, with 30% of international businesses saying it has already put more focus on prices in the sales process. To counter this, Robert advises that companies need to try to better communicate their culture and brand – including background, history, values, and what kind of experience employees have – which really resonates with customers, particularly larger corporates and governments.

Key elements of health from H2 2021

Restrictions weigh on further gains in outlook

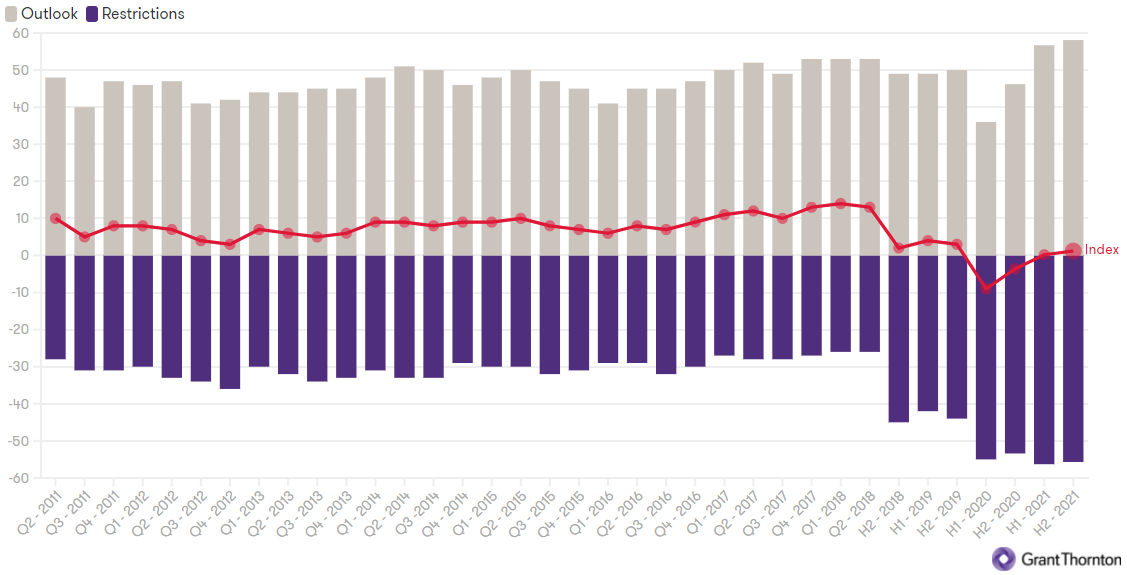

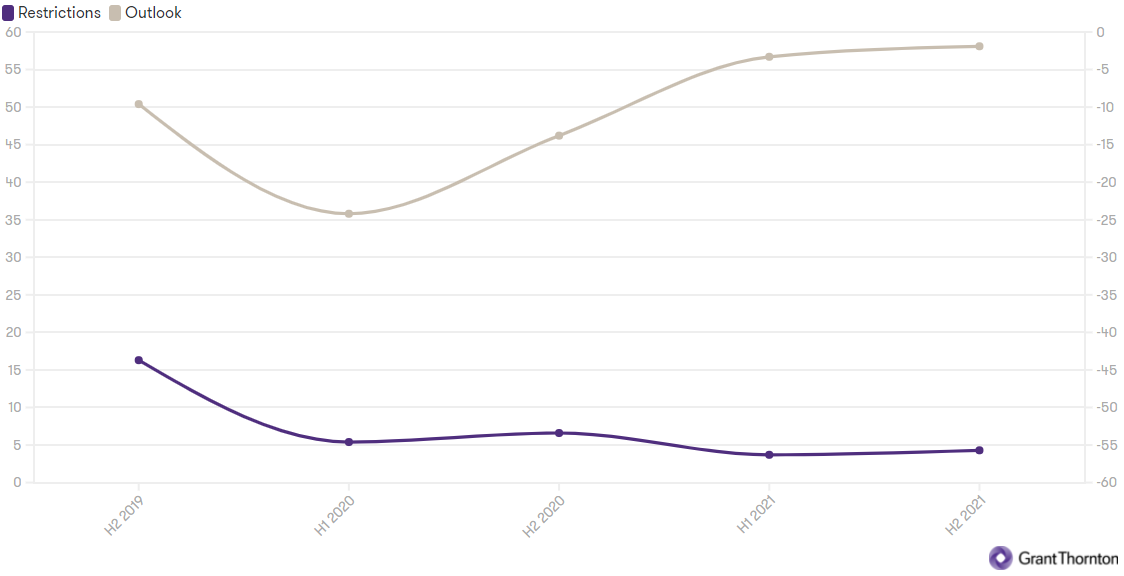

Grant Thornton’s index is composed of two elements: the outlook shows the growth expectations of the mid-market and the restrictions reveals the barriers to growth. The pattern over 10 years’ of data is that both of these tend to move in a similar direction. When the barriers to growth improve so too do the growth expectations, and vice versa.

But since the start of the recovery from the pandemic (H2 2020 onwards) we’ve seen these elements move in opposing directions: growth expectations have improved while barriers to growth have worsened. Graeme Harrison from economic consultancy, Oxford Economics, explains how this strange phenomenon occurred: “It has been a very interesting time. Normally we’d see the two move together, but during this strong rebound phase of the pandemic, the early strong growth has not only fuelled the strong outlook but also proved to be the source of some of these higher constraints, for example the higher wage costs, labour shortages and supply chain pressures.”

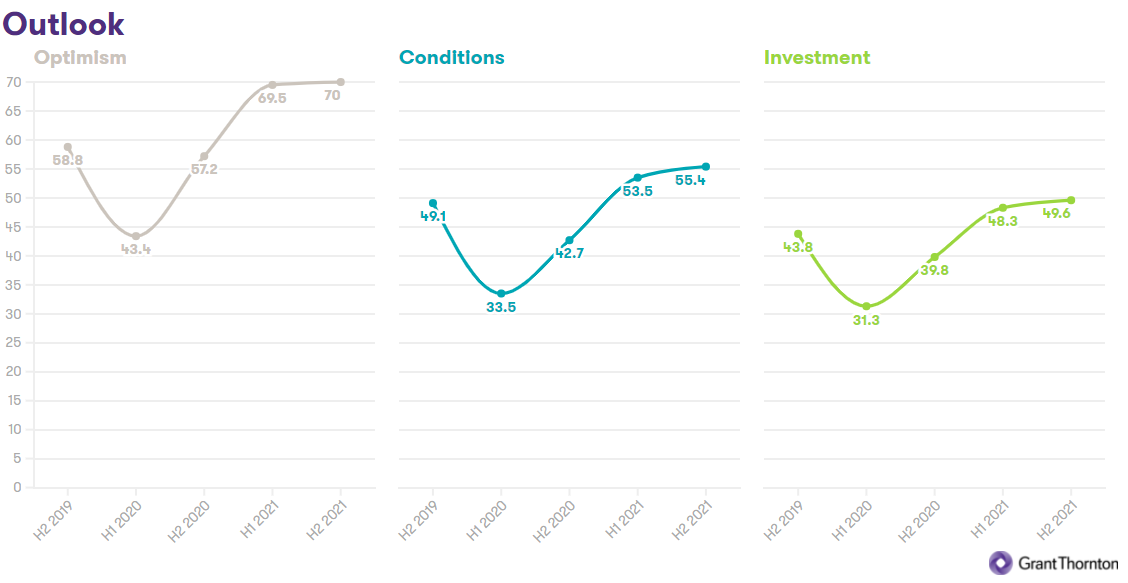

While the mid-market has dynamism on its side in the short-term according to these 2021 second half results, barriers to growth are beginning to bite and are likely to weigh on growth expectations in future results at the same time as economic growth starts to slow, government support is withdrawn and the health challenges from the pandemic continue. The outlook managed an increase of just 1.4 points to 58.1 in H2 2021, a dramatic slowdown from what we saw in H2 2020 and H1 2021, while the restrictions continued at roughly the same record levels. The balance of these two elements meant that the overall index climbed up only marginally during the period.

Business conditions and investments show most resilience

All three of the elements of health slowed sharply in H2 2021, but the upward momentum was best maintained by business conditions and investment intentions. In previous waves, we’ve seen a close correlation between these two, reflecting the fact that businesses make investment decision based on their own business outlook rather than the wider economic outlook, and this remains the case.

A big part of the continued improvement in business conditions relates to the higher selling price expectations. As mentioned above, these rose by 6 percentage points during the period, with 51% of companies expecting to increase prices in the next 12 months. This, in turn, helped to support the strong expectations for both revenue and profit growth. Another bright spot was employment expectations for the next 12 months, which are the strongest on record, with 52% of firms expecting to hire more workers, up from 48% in H1 2021.

All the investment categories meanwhile remained strong, with some hitting new record high levels in H2 2021. A larger proportion of firms continue to favour investment in staff, R&D and technology over investment in plant and machinery and new buildings, which should help efficiency and offset some of the risks of inflation. According to Morgan Stanley investment more widely has recovered faster that global growth meaning a more durable recovery is likely, as are productivity boosts.

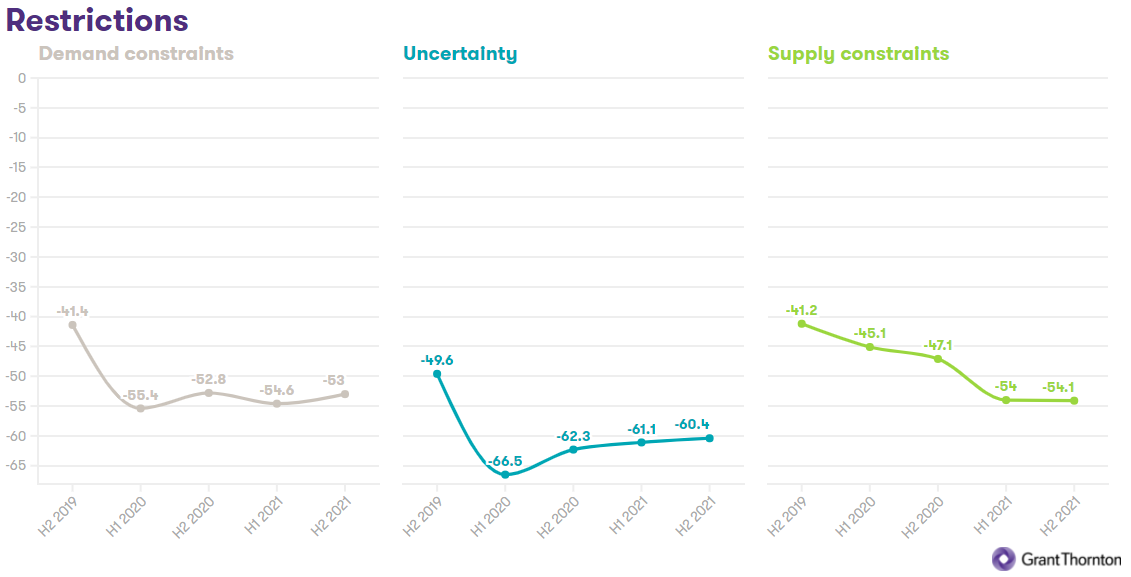

Supply constraints continue to bite

While we can take some encouragement from the marginal improvement in both demand constraints and economic uncertainty, restrictions are firmly rooted at their current high levels by concerns about supply constraints. Inflation is a big driver here, pushing up labour and energy costs, but other barriers relate access to finance, availability of skills and regulations and red tape.

At the H1 stage, we discussed the high levels of concerns about regulation and red tape, and noted that this was partly explained by the limitations, incentives and taxation linked to COVID as well as the new regulations and requirements around sustainability. To support the mid-market through the complexities of sustainability, Grant Thornton recently called on policymakers to create a route map that companies could follow and to consolidate reporting frameworks and standards. On the latter point, we have certainly welcomed the announcement that the IFRS Foundation will create a new board to develop sustainability disclosure requirements.

Against this backdrop and the emergence of the Omicron COVID-19 variant, 2022 looks set to be another challenging year for the mid-market, but Peter points to an inherent strength: “The mid-market now knows the COVID-19 playbook. Mid-market businesses are optimistic because they have been here before, adapted and succeeded. Businesses that stay focused, agile, and flexible, especially in the international arena, will continue to drive the economy in a positive direction and enjoy success.”

Supporting your pandemic recovery and realising your business ambitions

Please get in touch with us if you’d like to discuss the challenges or opportunities that you have at this stage in the pandemic. Our expert Andrew Dickson will be happy to assist you.