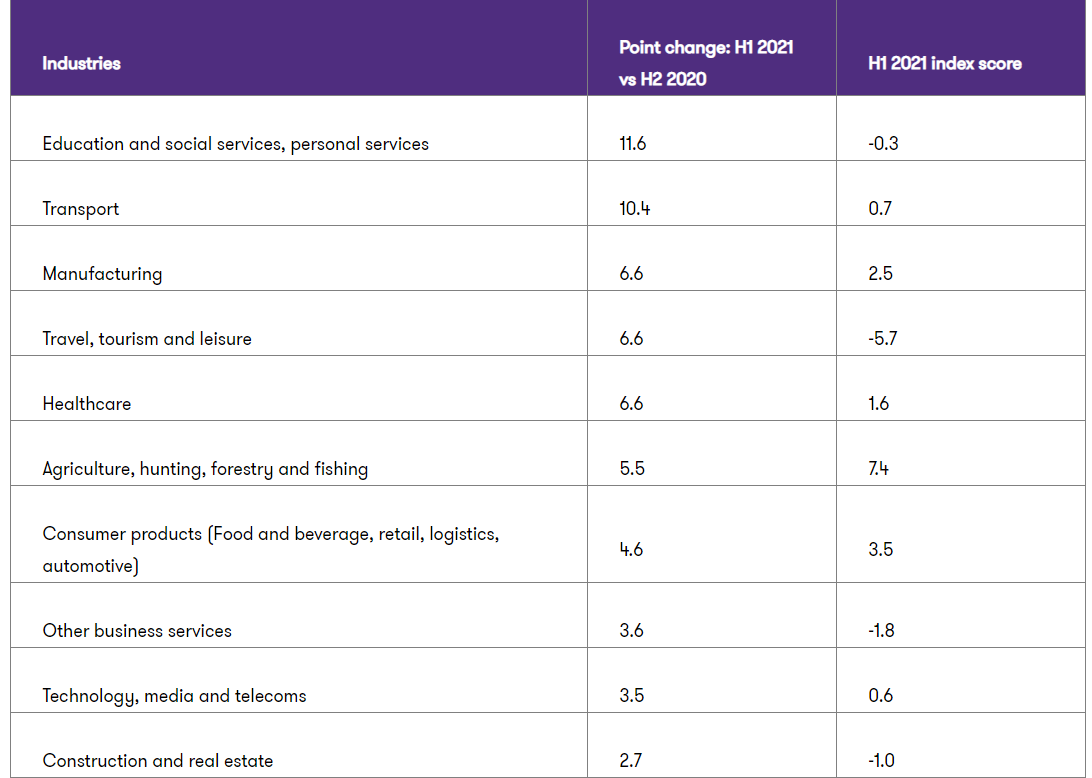

Among the biggest industry movers, transport jumped 10.4 points into positive territory to 0.7, while healthcare and manufacturing rose 6.6 points, both also returning to positive ground.

The travel, tourism and leisure (TTL) index also rallied in the past half-year, rising 6.6 points to -5.7, after experiencing falling revenue expectations and rising barriers to growth in H2 2020. The new research found that over half (58%) of the industry now expect revenues to increase, up from 27% in the previous half. But uncertainty remains high at 67%, with unpredictable travel restrictions and new outbreaks of the COVID-19 Delta variant forcing businesses to adapt to ever-changing circumstances.

Utilities and financial services were the only two industries to buck the upward trend, with the electricity, gas and water industry down 4.5 index points to 1.2.

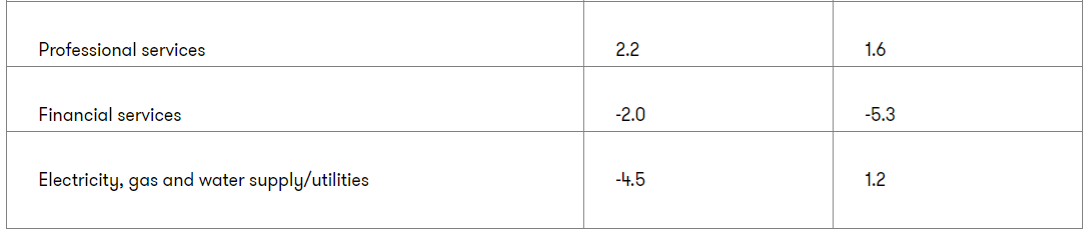

Global demand boosts technology revenue expectations

The telecoms, media and technology (TMT) industry turned positive in H1 2021, with the index marginally above the global average. The outlook in the sector surged to a record high of 67, driven by positive investment intentions and conditions. Conversely, restrictions worsened 9 points owing to rising concern about demand and supply constraints. The media sector was the most pessimistic in outlook.

Technology was the most optimistic sector within TMT, as technology investment and adaptation over the past 18 months continue to drive long-lasting change, as patterns of work life in particular keep shifting. TMT businesses anticipate a significant increase in revenues from international markets, and 53% of tech businesses will devote more employees to focus on international markets.

Fergus Condon, partner - financial accounting and advisory services, Grant Thornton Ireland, says that optimism in technology is partly a reflection of a more positive overall global economy. “That optimism trickles down into certain sectors more than it does to others, and tech is one of those sectors. It has not been as adversely affected as some by the pandemic. Meanwhile, the cultural change and acceptance of technology during COVID mean that the adoption of technology is going to be greater in the next 12 to 24 months.”

Among supply constraints, technology firms expressed concerns over a shortage of skills and rising labour costs, an issue predating the pandemic. More technology businesses are thinking about long-term talent supply, spreading the net wider to attract skills, and addressing the challenges that come with that.

Fergus says: “If you’ve got time, you might move away from your current city, if you’ve already exhausted the talent base there, perhaps towards a good university town. You should also look more widely and consider teams of people working in overseas locations. That brings with it challenges around having to pay employment taxes in those countries, issues around permanent establishments, and managing cultural aspects, too.”

With increasing internationalisation, differing and changing regulations become a more significant challenge. As Fergus says: “When businesses know what they have to pay in tax, they can deal with it. But when they don't know, because it hasn’t been settled yet, it makes life difficult. It affects investment decisions, especially when they haven't decided where they want to go.”

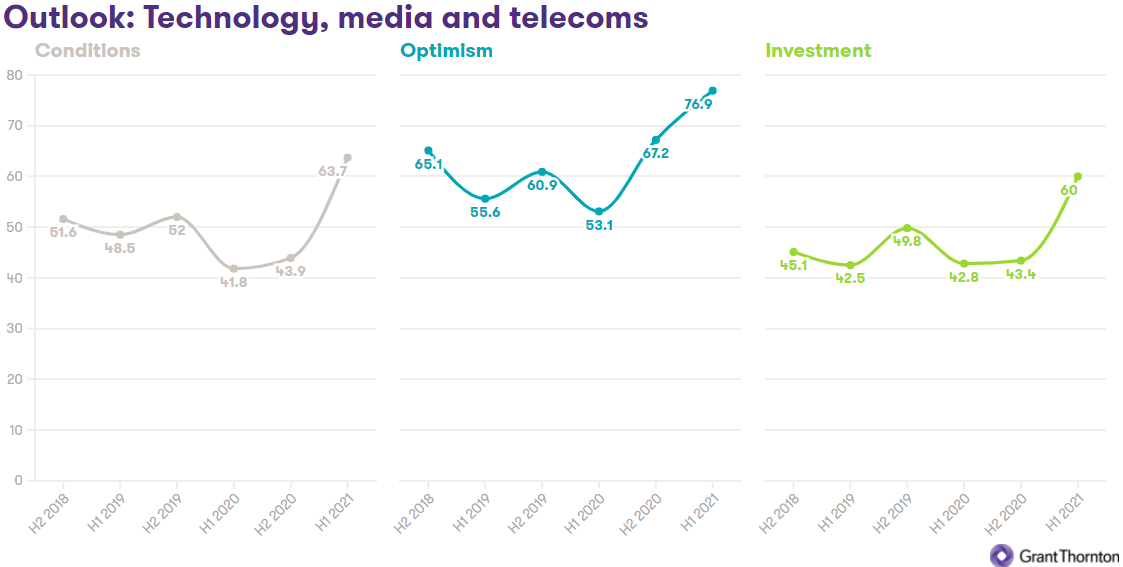

Shortage of finance and skills outweigh improved optimism in banking

After showing strength in H2 2020, the financial services (FS) industry index declined 2 points and remains in negative territory at -5.3. Supply and demand constraints dragged on the overall FS industry, despite a sharply improved outlook rising to 62, close to the record high of 64 in early 2017. Increasing optimism and improved conditions and investment supported the outlook, as economies started to open and other industries begin to look for finance to help them recover and grow.

While asset management was the most buoyant within the FS industry, banking has shown resilience over the past year, and optimism within the sector is in line with the global average. Banks' growth expectations for the next 12 months were above the global average.

Stephen Tennant, head of financial services advisory at Grant Thornton Ireland, says: “CEOs here are optimistic. Banks are needed more than ever, and while they have more competition from payment service providers, they’ve got market demand that’s not dropping.

“Banks were more focused on efficiency through the pandemic than they ever have been, and they are learning that they can do a lot of their operational activity more efficiently. And within digital banking, they realise they can interact with their customers more efficiently.”

Banks expressed concern about a shortage of finance, with 75% citing the availability of finance as a constraint, up from 61% in H2 2020. While this is not a concern in all jurisdictions, particularly in the US, it is a cause of contraction in some markets. Stephen says: “We are in a world where new entrants can get money more quickly and easily than banks, so that shortage of finance is an issue. And it’s why several banks are leaving the market in Ireland, for example.”

Another critical constraint is the supply of talent, with 73% of mid-market banks saying it was a significant constraint on growth.

Graham Tasman, risk advisory and banking sector lead at Grant Thornton US, says that there was already a need to transform skills within the sector before the pandemic. “If you’re going to offer new products and services, the labour and capabilities required to achieve that change are more technology-informed. It’s hard to find skilled people who understand banking, understand the products, can do commercial client relationship management, and also have a sufficient degree of technology awareness to drive the level of digital transformation in this new world.”

Graham adds: “The mobility constraints imposed by the global pandemic have shown that there’s more willingness to bank online across all generations; it’s not just younger people anymore. That may force more R&D in online and digital solutions and start to make institutions think about further limiting their retail footprint because that is a big cost item.”

Economic uncertainty remains a concern for the banking sector with 45% of the sector citing it has major constraint. Stephen Tennant notes: “While there is optimism within banks there is nervousness and uncertainty too on concern about which sectors are going to bounce back. While manufacturing, professional services, technology all seem to be rebounding robustly, there is concern around how long it will take retail, hospitality to recover and how well provisioned the banks are to cope with that.”

Vaccine success and pent-up demand spur optimism among life sciences

The overall healthcare industry index score turned positive in H1 2021, climbing nearly 7 points to 1.6, which is higher than the global average. The outlook rose by a robust 12 points to 52, above the pre-pandemic level of 51. This was driven by a strong rebound in optimism, shooting up 27 percentage points (pp) to 65%, following a sharp fall in H1 2020 and only modest improvement in H2.

The re-opening of countries is certainly supporting demand and boosting optimism. The industry is also benefiting from a change in its public image.

Amy Flynn, life science leader at Grant Thornton US, says: “During the pandemic, life science companies collaborated in ways that they haven’t in the past. They have had incredible success developing, producing and distributing vaccines at speed never seen before, and they’ve experienced a very positive perception around the world.”

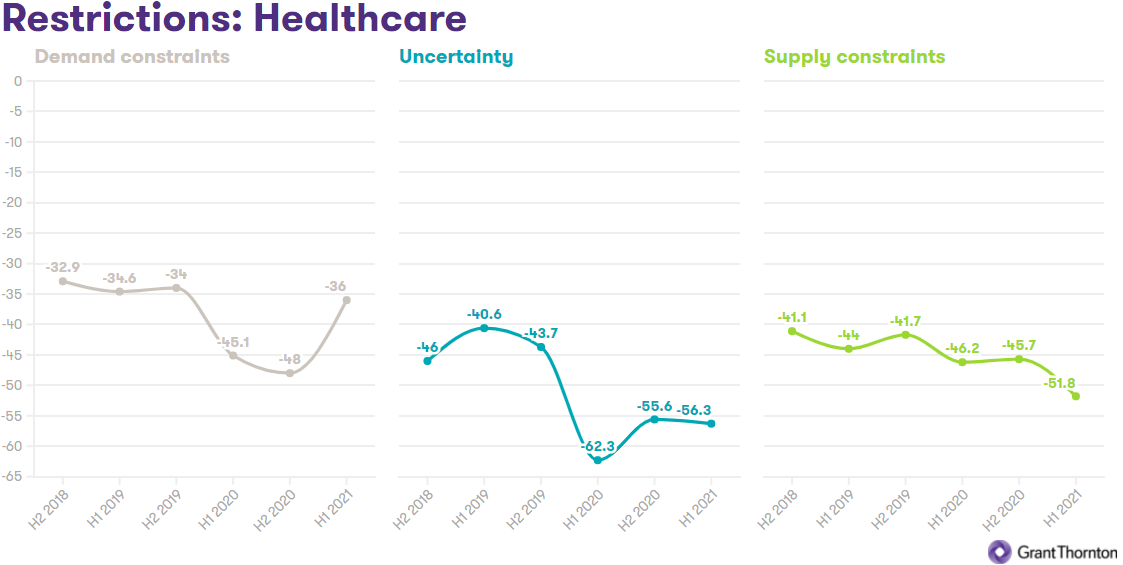

Restrictions improved slightly in the overall healthcare industry, led by a strong recovery in demand constraints, rising by 12 points from H2 2020 to -36, just 2 points from the pre-COVID-19 level and one of the best performing industries in the first half of 2021. But while demand constraints improved, supply constraints worsened, falling to a new record low of -52.

Elaine Daly, head of business consulting at Grant Thornton Ireland, explains: “All the built-up demand is now placing pressure on supply. The system is trying to catch up and may do so by increasing capacity, which will in turn require additional staffing. Life sciences did not experience as high a level of staff lay-offs during the pandemic as other sectors, and businesses may find it difficult to recruit qualified and experienced staff.”

Investment intentions, while seeing an improvement, were more muted than other industries. However, intentions to invest in technology increased, up 18pp to 64%, to levels not seen in healthcare since late 2017. Technology and data are becoming more important in life sciences, with the pandemic highlighting the role technology plays in these sectors, as many businesses had to leverage digital capabilities to enable customer interaction and service.

As Amy Flynn points out: “Through the pandemic, we saw the importance of technology. Technologically-sound organisations were better able to respond to challenges.”

Read more insights

You can read about how other industries and the different regions are faring in the global economy in our Business health section. Or visit Retuning your business to read more about steps business can take to move from crisis management to restoring and rebuilding.

Take me to the Global business pulse

If you want to discuss any of the topics raised, please contact our expert Andrew Dickson.